How Long Does a Seller's Market Last? Analyzing Real Estate Cycles

During a seller’s market, homeowners want to know if they should sell their home now, or wait a bit longer in order to get top dollar. Home buyers feel pressure to buy a home before the market rises out of their price range. Both groups want to know; how long does a seller’s market last? Economic research and real estate cycles can help to answer this question. We’ve taken another look at this blog post to see what market conditions are like heading into 2020, and how long this seller’s market might continue.

How Long Does A Seller’s Market Last?

What is a Seller’s Market and When Does It Happen?

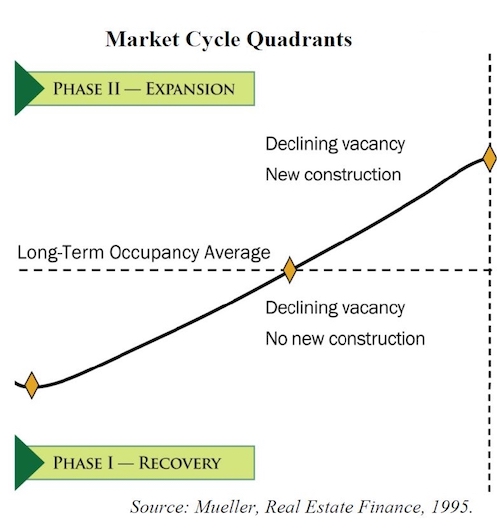

Predicting rises and falls in the real estate market will help to answer the question, how long does a seller’s market last? And how long will this seller’s market last? In a seller’s market, including the current Michigan real estate market and most other areas across the nation, the demand for homes is greater than available housing inventory, making it much easier to sell a home. Seller’s markets occur during rising real estate markets, while buyer’s markets occur during falls, when many homeowners try to sell their homes at once and there are fewer buyers.

In 2018, we took a look at these cycles and where we were on the timeline. As we enter 2020, where are we now? Is the seller’s market set to end soon, or will it continue for several more years? Let’s take a look

Can a Seller’s Market Be Predicted?

Savvy investors and economists have noticed that real estate booms and busts come in cycles. Though a shock to America’s system, the financial crisis of 2008 and the real estate fall wasn’t a mystery to some. Economists have studied business cycles and real estate rises and falls as early as 1800, and these studies predicted a recession occurring around 2008 as early as 10 years before. This fall marked not only a business cycle downturn, but also a downturn in the real estate cycle. After the fall, recovery began, which later ushered in the start of a new seller’s market, where we are today.

Can this help us to predict how long the seller’s market will last? Will it last in 2020?

Free Download: Home Selling Preparation Checklist

How Long Does a Seller’s Market Last: Using Real Estate Cycles

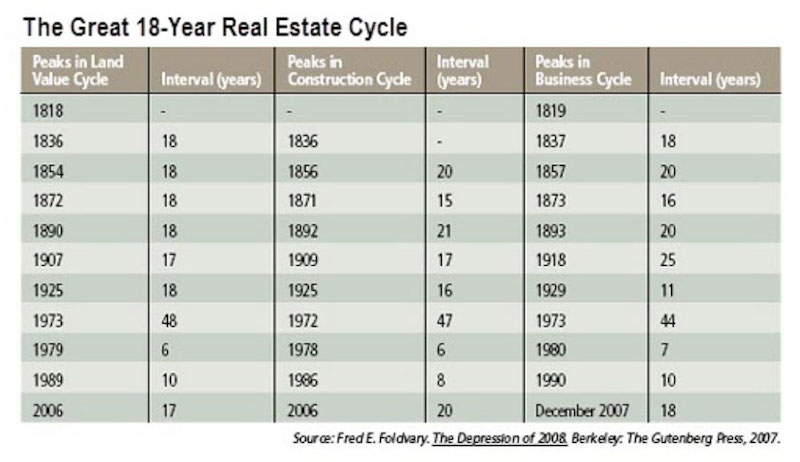

Economists Henry George and Homer Hoyt, among others, studied real estate cycles as early as 1800. Hoyt’s research showed the U.S. real estate market follows a pattern of roughly 18-year cycles, and this has held mostly true for over 200 years. Modern-day economists like Fred Foldvary, Fred Harrison, and Robert Schiller continued to study these cycles, and were able to accurately predict the collapse of 2008 due, in part, to these patterns.

This research is helpful in predicting how long a seller’s market lasts because it not only reveals a pattern, but also shows how long rises last compared to falls. The rises in these cycles are much longer than the falls. Falls, where housing prices sink and buyer’s markets occur, happen relatively quickly over about 2 or 3 years. Real estate recovery periods and booms take up the majority of the cycle, lasting about 15 or 16 years.

Has the Pattern Held True?

With two more years gone and further distance from the previous recession, we can see how this pattern has—or hasn’t—played out in reality. In this case, the model seems to be accurate. The previous market high occurred around 2006, and then fell sharply. This invoked a two-year fall, which leveled off in 2008. This began a wary rising action as the economy recovered, and expansion slowly began again. If economist Fred Harrison is correct, and economic recovery occurs in two halves—a 7 to 8 year gradual rise, then a 7 to 8 year rapid rise—2020 would put us directly in the middle of a boom. With unemployment low, income rising, consumer confidence high and demand for homes very high, this prediction seems accurate.

What About the Housing Shortage?

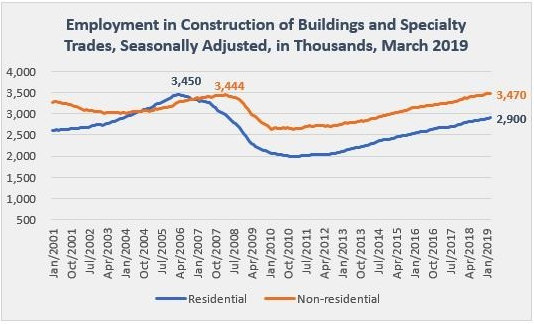

However, one piece of the puzzle is missing. A notable part of a real estate boom—and a notable contributor to a subsequent fall—is a period of rapid construction. Residential construction has yet to rebound to pre-recession rates.

This could be because the previous fall—worsened by the subprime mortgage crisis, which was outside the norm for these cycles—hit residential construction especially hard, particularly the small and mid-size construction companies which specialize in residential home starts. Non-residential construction is actually higher than it was pre-recession, indicating that big construction companies were able to recover, but their smaller counterparts did not.

However, with 2020 being, theoretically, in the middle of a boom, there’s still 4 years for residential construction to surge. Most likely, a housing shortage will remain in 2020, keeping home prices high. This may encourage uncertain construction businesses to start building again. Though this will be good news for homebuyers entering the market at the latter half of the peak, it’s bad news for the overall cycle. A surge in home starts will even out supply and demand over the next four years, lowering home values that were kept artificially high by a lack of supply.

This chart shows that, though non-residential employment in construction has rebounded, residential construction has not (Source: National Association of Realtors )

How Long Will This Seller’s Market Last?

Using the previous boom and bust, the current rise, current market conditions and this 18-year theory, economists can predict a general timeline for how long the seller’s market will last. Economists who predicted the previous fall around 2007 have predicted another occuring around 2024, including Robert Schiller, Fred Foldvary, and Fred Harrison, among others. Some debate remains around the severity of the fall, which is usually determined by other factors.

If the 18-year model proves accurate, then 2020 means the middle of a real estate boom. New home construction has yet to catch up, so this will mean a strong seller’s market for 2020. However, for the peak to occur at around 2024, housing starts must rebound soon, and may surge around 2021-2022.

Will The 18-Year Cycle Continue in 2020?

Other factors such as interest rates, government policies and subsidies, mortgage rates, lending, and international conflict, as well as regional real estate market differences, can affect these swings by two or three years, but they have not, historically, stopped the 18-year cycle itself (with the exception of World War II). Historic and modern economists say this is partly due to the nature of land ownership, investment, taxation and development, not other economic factors. Though the events of 2020 will probably spur dramatic stock market swings and sway consumer confidence, they’re unlikely to stop or slow the march of the 18-year real estate cycle.

No one can say for certain how long a seller’s market will last, but previous research and historic trends can help us make a prediction. With this in mind, seller’s can expect the market to favor them for at least another two or three years.